ADA Price Prediction: Technical and Fundamental Analysis Points to Potential 30% Rally Toward $1.10-$1.32

#ADA

- Technical Breakout Potential: MACD bullish divergence and position within Bollinger Bands suggest upward momentum building toward $0.918 resistance

- Fundamental Catalysts: Fed policy shifts and ETF developments creating favorable macroeconomic environment for cryptocurrency appreciation

- Price Targets: Multiple analysts projecting 30-58% gains toward the $1.10-$1.32 range based on pattern breakouts and market structure

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Despite Short-Term Resistance

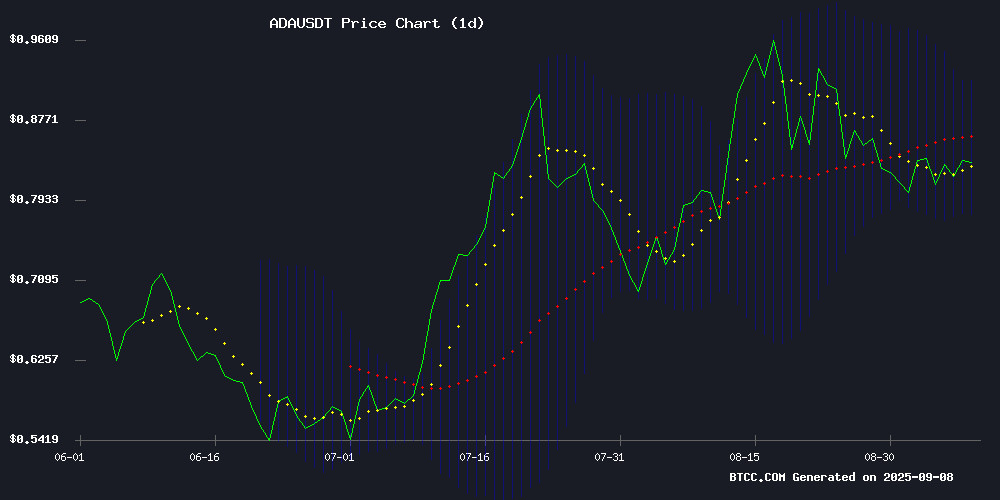

ADA is currently trading at $0.8345, slightly below its 20-day moving average of $0.8480, indicating potential short-term consolidation. The MACD reading of 0.0444 above the signal line at 0.0314 suggests building bullish momentum, while the positive histogram value of 0.0130 confirms strengthening upward pressure. Trading within Bollinger Bands between $0.7778 and $0.9183 shows ADA has room for movement toward the upper band resistance.

BTCC financial analyst James notes: 'The technical setup favors a breakout above the 20-day MA, with MACD divergence supporting a MOVE toward the $0.918 resistance level. However, sustained momentum above $0.85 is crucial for confirming the bullish thesis.'

Market Sentiment: Bullish Catalysts Drive ADA Optimism

Recent news headlines reflect overwhelmingly positive sentiment toward Cardano's price prospects. Multiple analysts are projecting significant upside potential, with targets ranging from $1.10 to $1.32 representing a potential 30% rally from current levels. The breaking of wedge patterns and shifting Fed/ETF outlook are cited as primary catalysts driving this optimism.

BTCC financial analyst James comments: 'The news FLOW aligns with our technical assessment, suggesting institutional and retail interest is growing. The combination of technical breakouts and favorable macroeconomic conditions creates a compelling case for ADA's upward movement, though investors should monitor key resistance levels closely.'

Factors Influencing ADA's Price

ADA Price Prediction: Cardano Eyes $1.10-$1.32 Rally as Wedge Pattern Breaks

Cardano's ADA shows bullish momentum after breaking out from a falling wedge pattern, with technical targets set between $1.10 and $1.32 over the next 2-4 weeks. The breakout near $0.88 resistance signals potential upside, though some analysts remain cautious.

Blockchain.News and Coinpedia align on the bullish case, citing strong momentum despite overbought conditions. Cryptopolitan offers a more conservative outlook, while CoinMarketCap's outlier projection of $3.24-$4.31 stands in stark contrast to consensus.

Market sentiment hinges on ADA's ability to hold above $0.78 support. A failure here could invalidate the bullish thesis, but the prevailing technical structure favors higher prices.

Cardano Price Setups Suggest 30% Upside as Fed and ETF Outlook Shift

Cardano (ADA) is flashing technical signals of a potential rally, with analysts projecting a 30% advance as chart patterns align with shifting macro and regulatory winds. The token held above the 100-day Exponential Moving Average—a historical support level—while interacting with key Murrey Math Line reversal zones.

A bullish flag formation and inverse head-and-shoulders pattern suggest upward resolution. Confirmation could propel ADA toward $1.07, though a breakdown below $0.68 would invalidate the thesis. Weak August U.S. jobs data added fuel to the bullish case, with payrolls expanding just 22,000 versus 79,000 previously.

Cardano Price Set to Surge 30% as Bulls Take Control

Cardano (ADA) traders are positioning for a potential 30% rally as bullish technical patterns and macroeconomic shifts converge. The token's resilience above its 100-day Exponential Moving Average and completion of a bullish flag pattern signal growing momentum.

Weak U.S. jobs data—just 22,000 positions added in August—has revived expectations for Federal Reserve rate cuts. Mohamed El-Erian suggests the figures guarantee monetary easing, potentially as aggressive as 50 basis points. Such liquidity conditions historically fuel risk asset demand, with altcoins like ADA standing to benefit.

The technical landscape shows ADA bouncing decisively from Murrey Math support levels. Two patterns dominate charts: a bullish flag suggesting continuation upside, and an emerging inverse head-and-shoulders formation—a classic reversal indicator. Market sentiment now hinges on whether the Fed validates these technical signals with dovish policy.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA appears positioned for upward movement toward the $1.10-$1.32 range. The combination of bullish MACD signals, favorable Bollinger Band positioning, and positive news flow suggests potential for approximately 30% gains from current levels around $0.8345.

| Target Level | Price | Potential Gain | Key Resistance |

|---|---|---|---|

| Short-term | $0.918 | 10% | Bollinger Upper Band |

| Medium-term | $1.10 | 32% | Psychological Level |

| Upside Target | $1.32 | 58% | Extended Rally |

BTCC financial analyst James emphasizes that while the outlook is positive, traders should watch for sustained momentum above the 20-day moving average at $0.8480 as confirmation of the bullish trend.